Halo teman-teman netez.id! Hari ini, saya ingin berbagi hasil dari perkuliahan saya, di mana dalam tutorial ini kita akan membahas cara menginstal Laragon, kemudian menginstal WordPress, dan terakhir melakukan backup serta mengimpor basis data dan situs web.

Pertama-tama, Laragon adalah lingkungan pengembangan lokal yang kuat untuk pengembang web. Ini memungkinkan Anda membuat dan mengelola situs web dengan mudah dengan fleksibilitas yang besar. Menginstal Laragon sangatlah mudah. Anda dapat mengunduh installer dari situs web resminya dan mengikuti petunjuk yang ada. Setelah diinstal, Laragon menyediakan antarmuka yang ramah pengguna untuk mengelola proyek-proyek Anda.

Selanjutnya, menginstal WordPress di Laragon cepat dan mudah. Laragon dilengkapi fitur aplikasi cepat yang memungkinkan Anda menginstal aplikasi populer seperti WordPress hanya dengan beberapa klik. Setelah WordPress diinstal, Anda dapat mengaksesnya melalui browser web Anda dan mulai membangun situs web Anda.

Terakhir, melakukan backup dan mengimpor basis data dan situs web di Laragon sangat penting untuk menjaga proyek-proyek Anda. Laragon menyediakan alat-alat untuk dengan mudah melakukan backup basis data dan situs web Anda. Anda kemudian dapat mengimpor kembali backup ini kapan pun diperlukan, memastikan proyek-proyek Anda aman dan terjamin.

Secara keseluruhan, menguasai instalasi Laragon, WordPress, dan proses backup/impor sangatlah penting bagi pengembang web. Ini memperlancar alur kerja pengembangan dan memastikan proyek-proyek Anda selalu ada backup-nya dan dapat diakses.

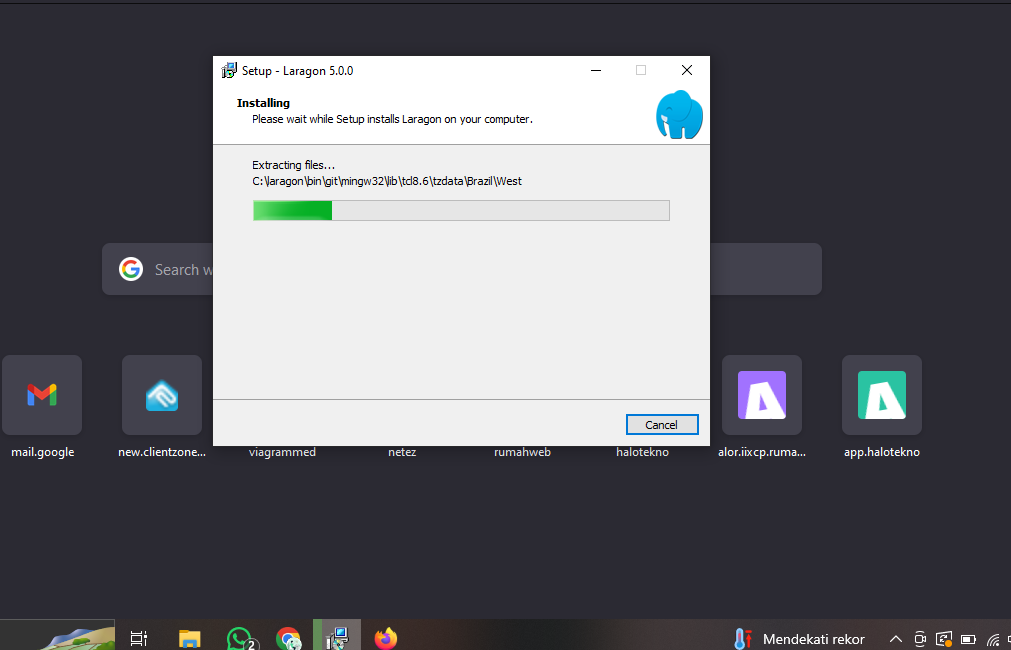

Cara Instal Laragon dengan phpmyadmin

- pertama silahkan download terlebih dahulu file laragon dengan link di bawah ini: https://laragon.org/download.html

- jika udah selesai silahkan klik 2 kali, kemudian instal silahkan next terus sampai laragon anda terinstal.

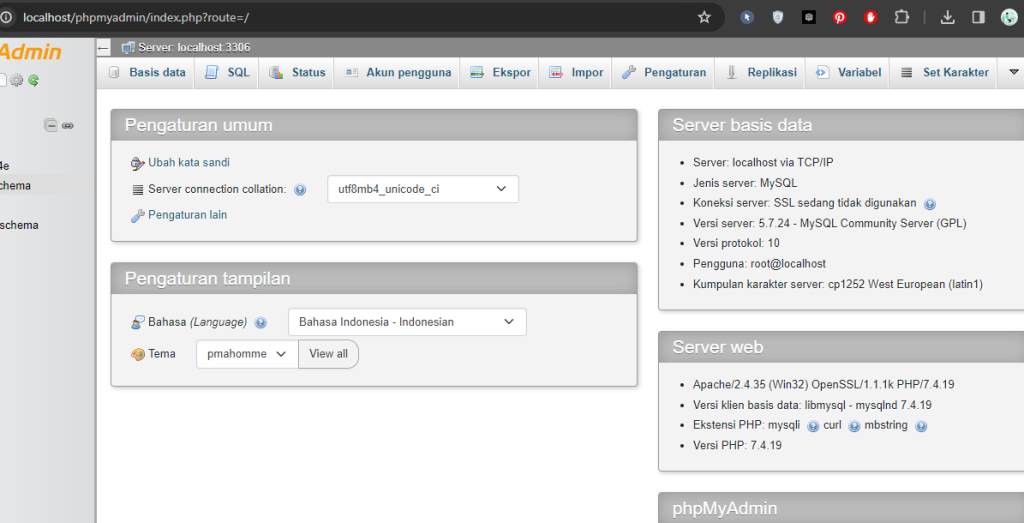

- kemudian silahkan download juga phpmyadim melalui link di bawah ini: https://www.phpmyadmin.net/downloads/

- setelah di download kemudian ekstrak dan pindah ke folder disini seperti gambar di bawah ini

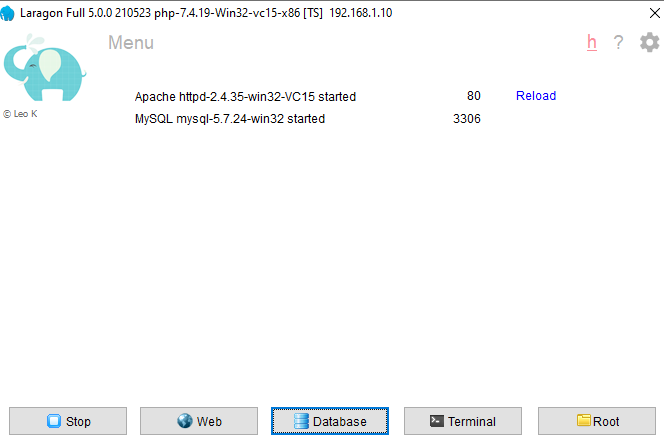

5. kemudian silahkan buka laragon anda dan klik database

6. kemudian silahkan login ke phpmyadmin anda dengan username root dan passwornya di kosongkan maka akan di bawah ke homepage phpmyadminnya

Instal wordpres di localhost

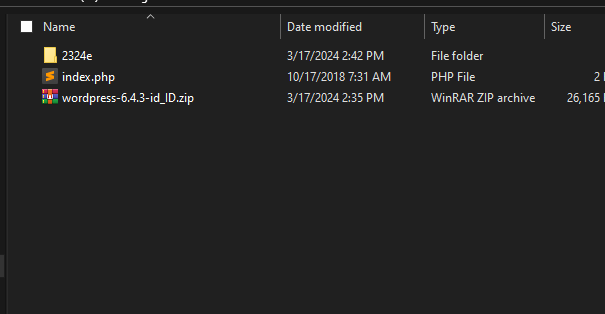

- langkah pertama silahkan download wordpres.org nya melalui link berikut: https://id.wordpress.org/download/

- selanjutnya dilahkan ekstrak file wordpres tersebut di dalam laragon/www anda kemudian rename file tersebut, kalau saya: 2324e/lps4j

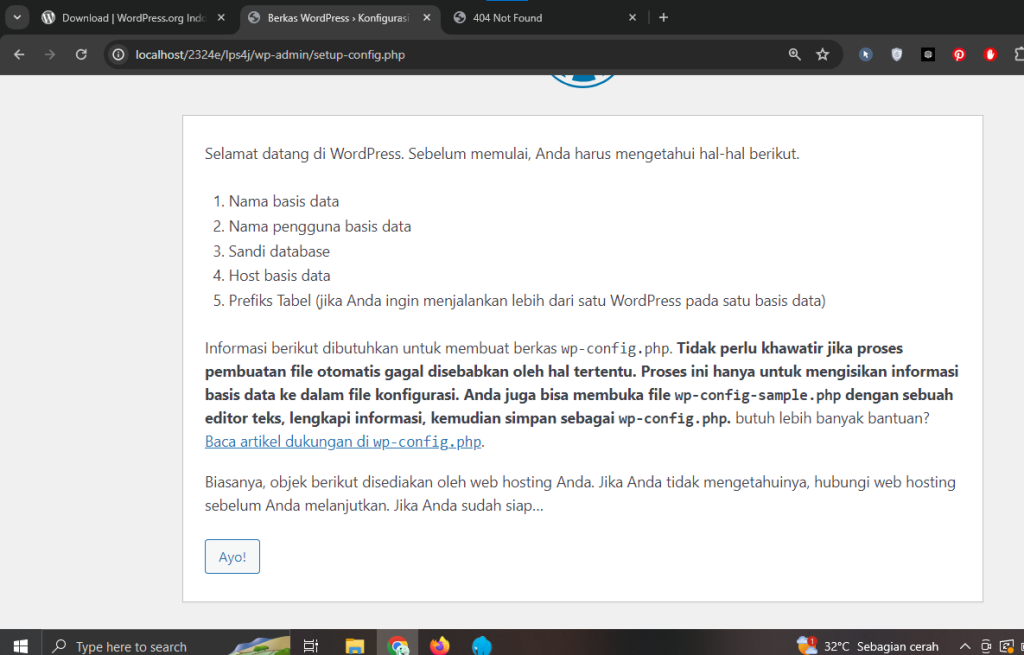

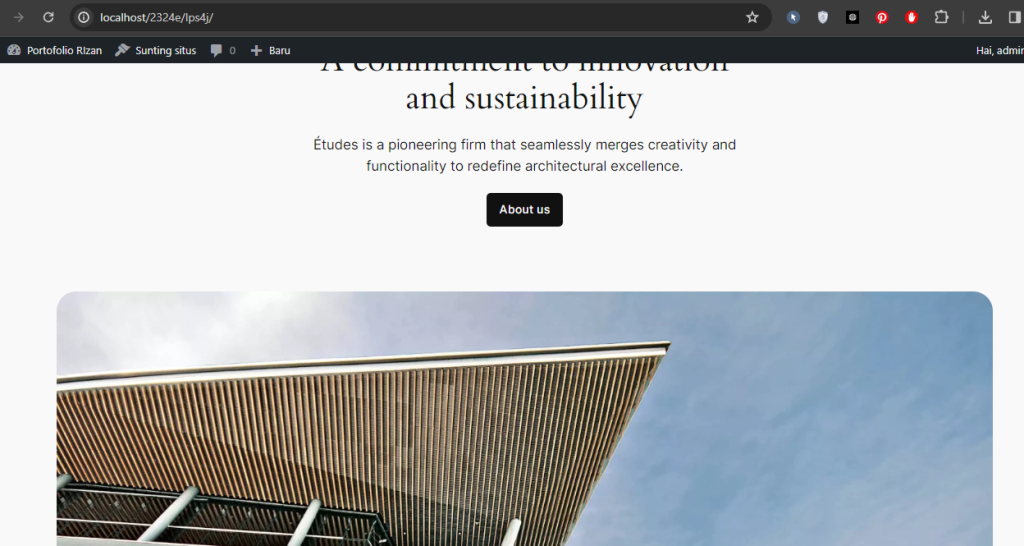

- kemudian silahkan buka browser anda kemudian ketik seperti link di bawah ini: localhost/2324e/lps4j/ maka akan tampil seperti di bawah ini

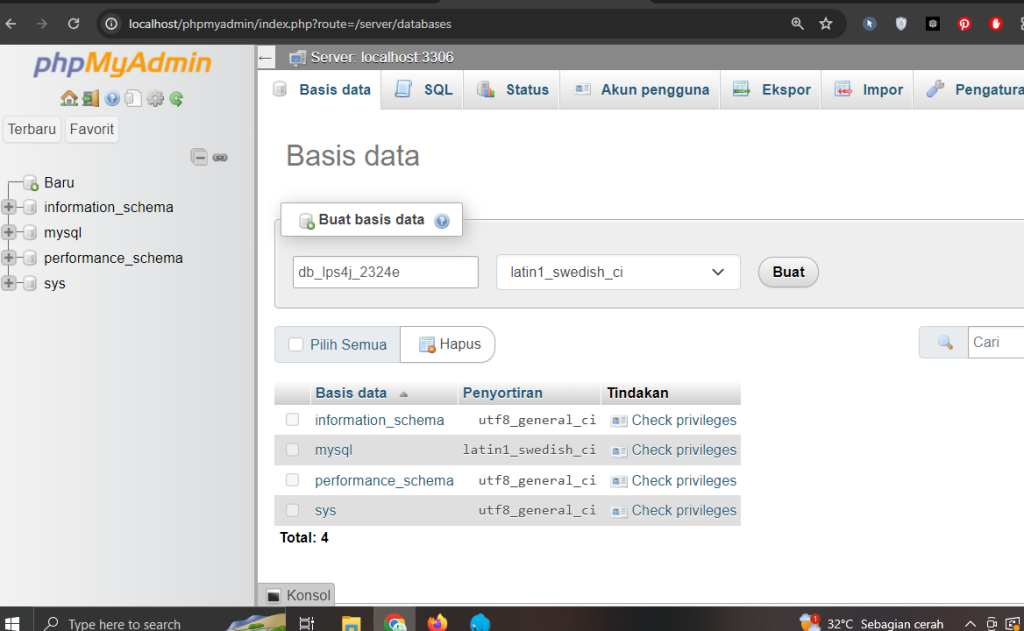

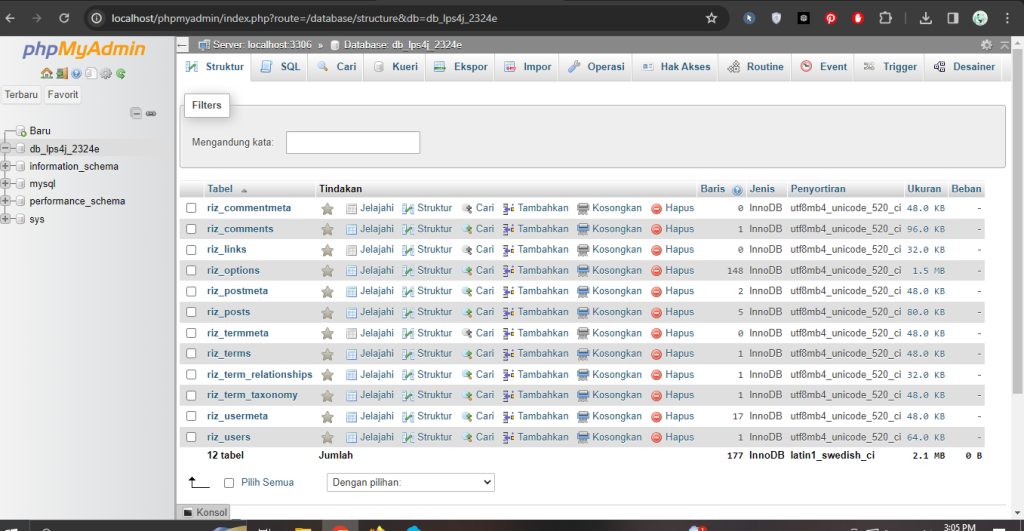

4. kemudian buatlah databse terlebih dahulu di local host, caranya gampang klik icon new kemudian madukan nama database anda kalau saya disini: db_lps4j_2324e kemudian klik buat

5. setelah selesai silahkan kembali ke step 3 tadi ke webrowsernya kemudian klik ayo, setelah itu silahkan isi informasi di bawah ini, tapi inget untuk databasenya harus sama dengan yang telah dibuat tadi

6. maka setelah di klik kirim akan muncul tampilan seperti ini silahkan klik jalankan pemasangan

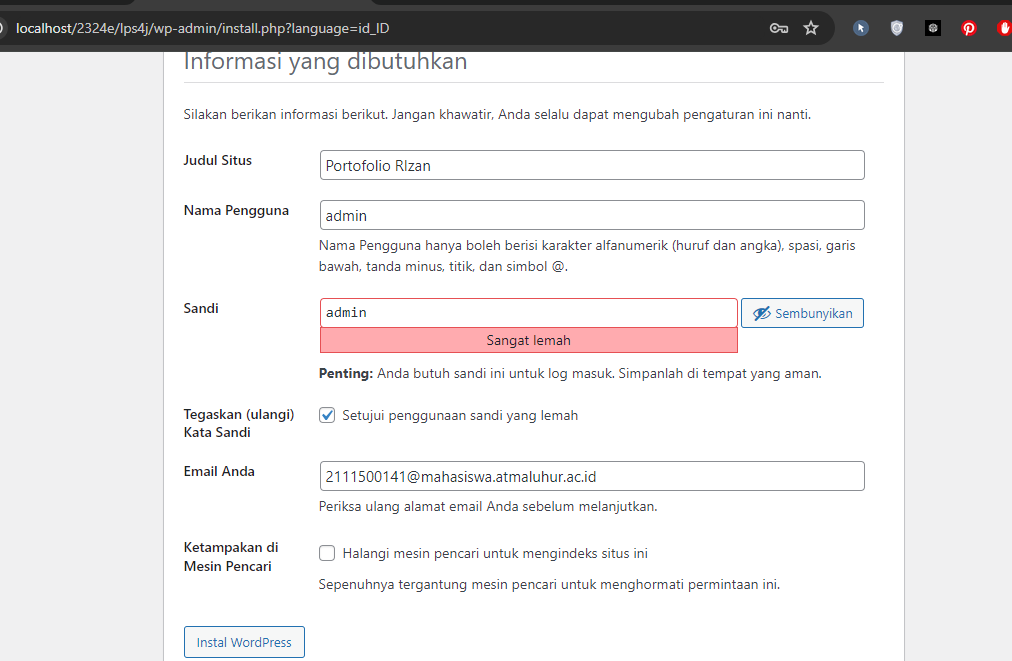

7. setelah itu isikan informasi tambhakan seperti di bawah ini sesuai dengan anda inginkan

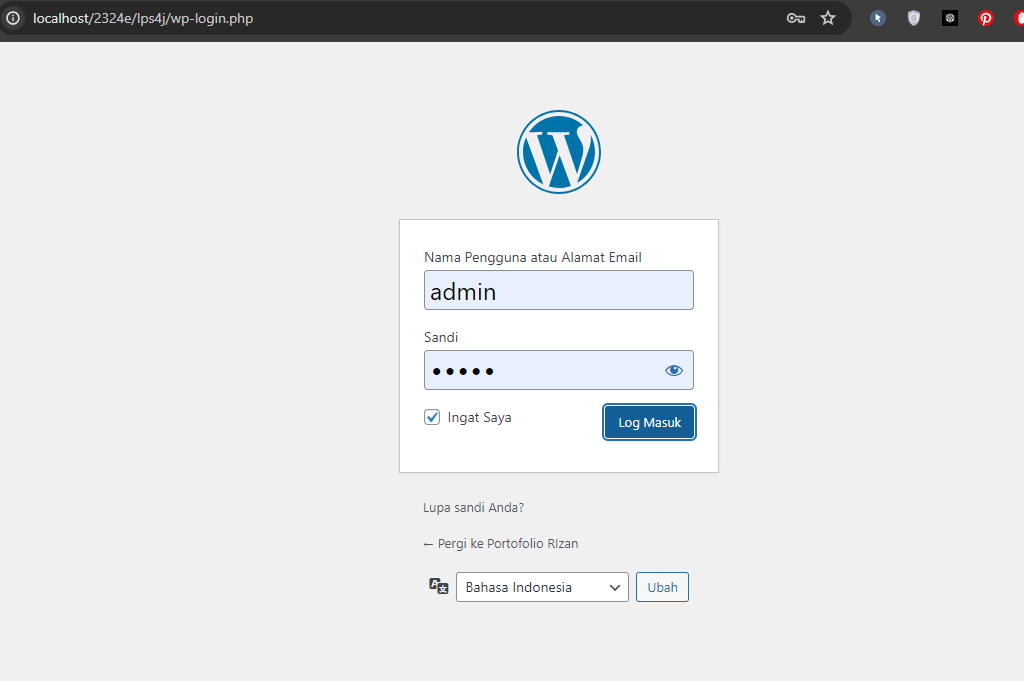

8. setelah di klik instal wordpres maka wordpres pun selesai di instal kemudian silahkan login dengan username dan password yang telah di buat tadi

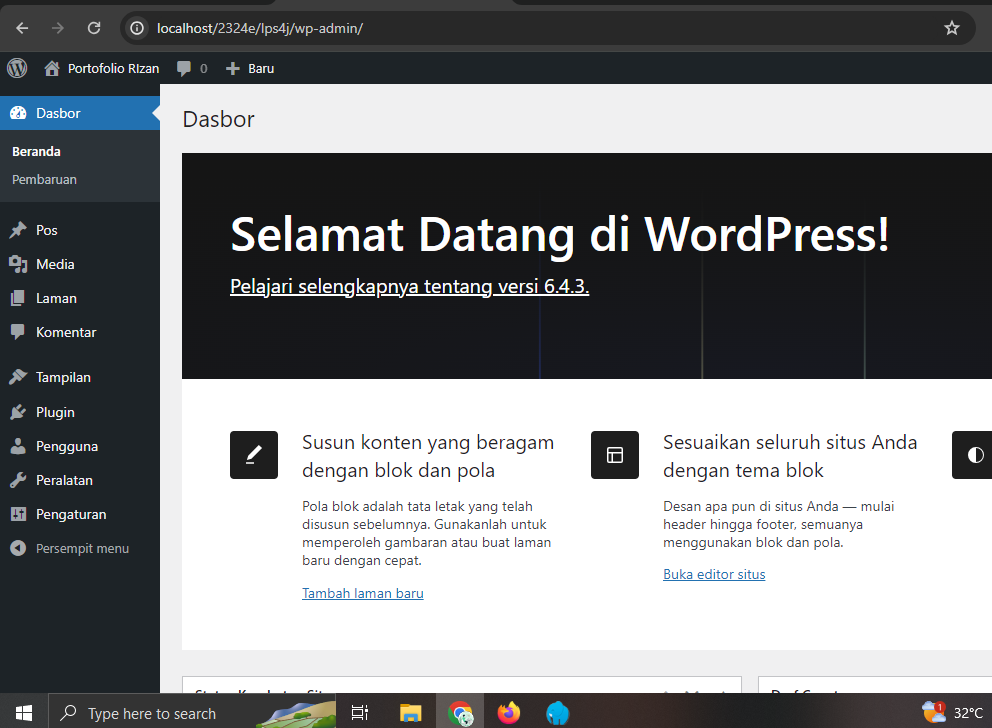

9. ini merupakan tampilan dasbor dari wordpres yang telah kita buat sebelumnya

10. ini adalah tampilan databse yang telah terisi atau terinstal wordpres ada belasan tabel

11. ini adalah tampilan website kita

Cara backup database dan aplikasi

cara backup database cukup gampang tinggal:

- buka localhost anda

- kemudian klik databasenya

- klik ekspor

- klik ekspor

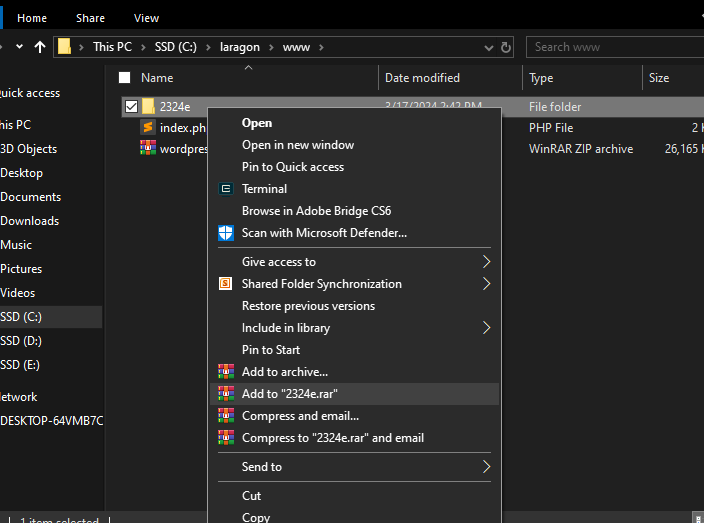

cara backup aplikasi/website cukup gampang silahkan buka laragon anda

- buka file www

- kemudian pilih file website anda

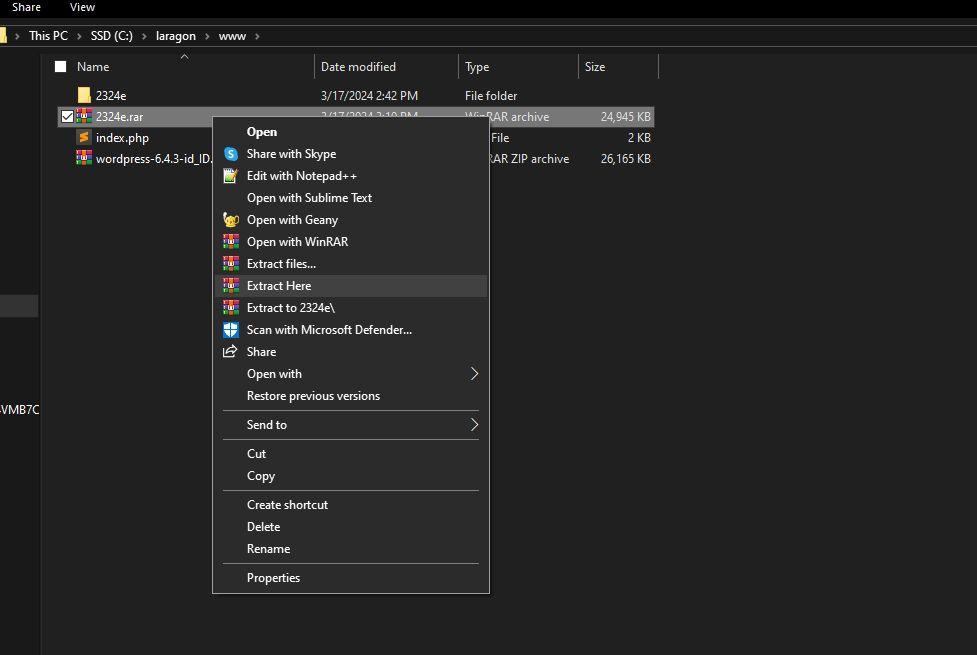

- kemudian klik kanan terus pilih rar

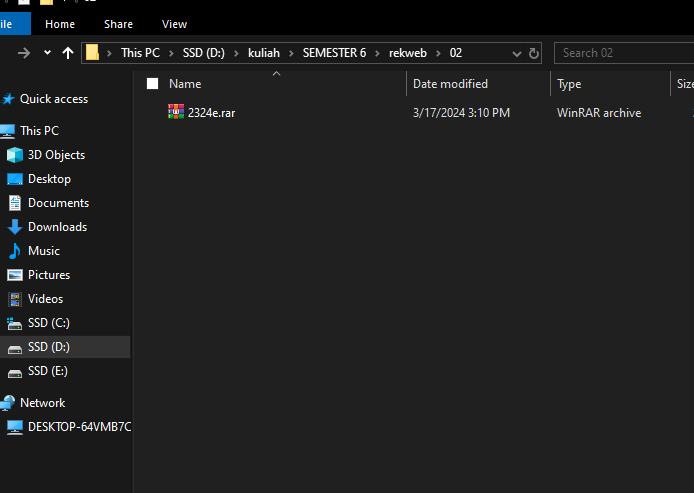

- selesai silahkan pindah hasil rara sesuai dengan anda inginkan

Cara import database dan restore aplikasi

cara backup database ikuti langkah di bawah ini

- silahkan buka localhost anda phpmyadmin

- kemudian klik import

- kemudian klik choose file

- masukan file database yang di ingkan

- klik open dan klik import

- tunggu sampai selesai biasanya warna hijau

cara restorasi website/aplikasi

- pertama silahkan copy file backup apliaksi

- paste ke file laragon ke www

- ekstrak filenya

- selesai

maka tampilan website anda akan seperti semula

Kesimpulan

Dalam kesimpulan, belajar cara menginstal Laragon, WordPress, dan mengelola backup serta impor sangatlah penting bagi pengembang web. Laragon menyediakan lingkungan yang ramah pengguna untuk pengembangan lokal, sehingga memudahkan dalam membuat dan mengelola situs web.

Menginstal WordPress di Laragon cepat dan sederhana, memungkinkan pengembang untuk memulai membangun situs web dengan efisien. Selain itu, menguasai proses backup dan impor memastikan bahwa proyek-proyek aman dan dapat dikembalikan jika diperlukan. Secara keseluruhan, keterampilan ini sangat mendasar untuk alur kerja pengembangan web yang lancar dan efisien.

untuk lebih lanjut bisa cek vidio di bawah ini iya: